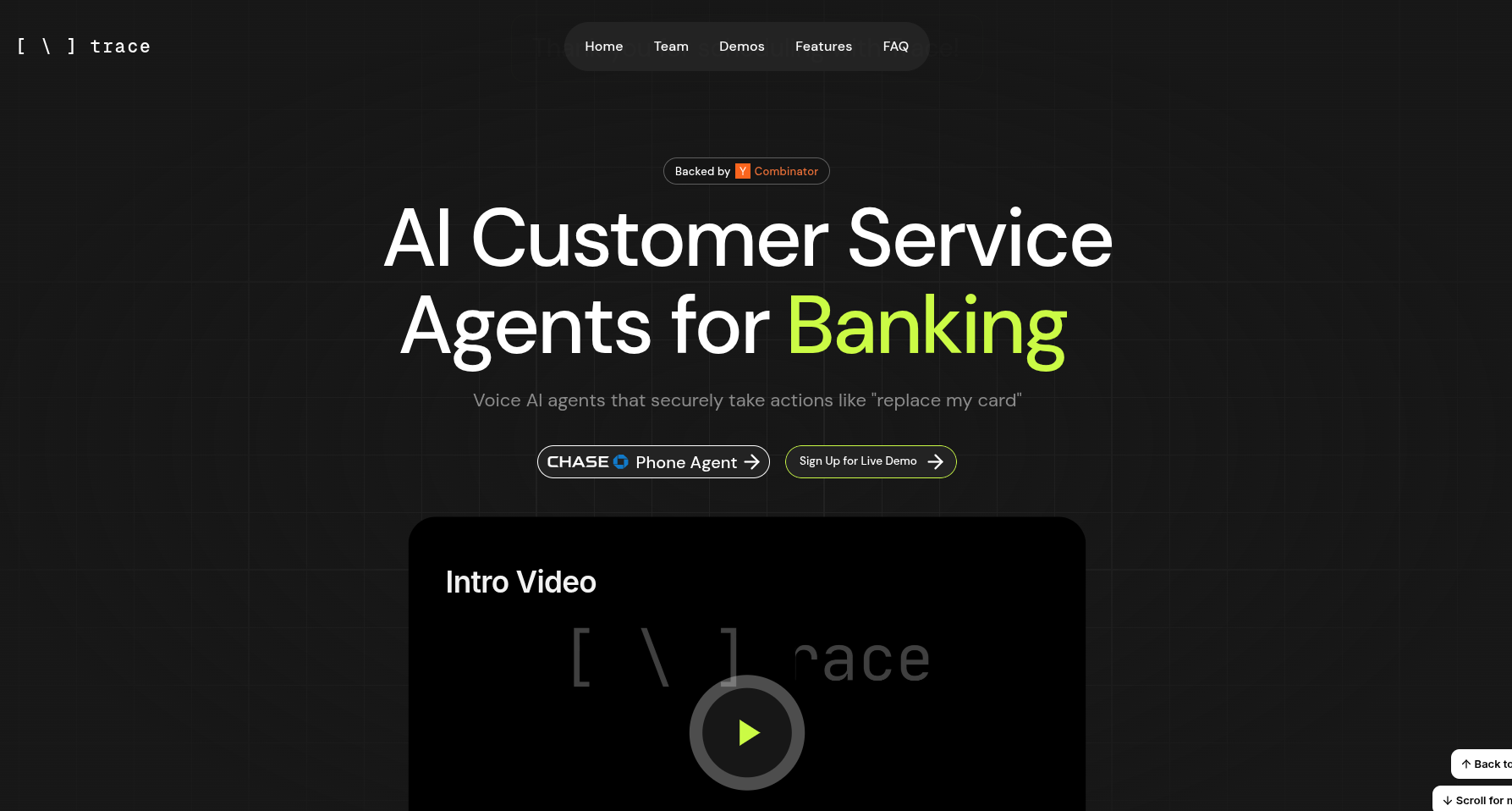

Trace

AI voice agents for secure, automated customer service in finance.

About Trace

Trace: AI Voice Agents for Fintech, Banking, and Insurance

Trace is an AI-powered platform providing advanced voice agents designed specifically for fintech, banking, and insurance companies. Trace’s agents go beyond answering questions-they securely perform real customer service actions (like replacing cards, tracking transactions, and resolving lockouts) by integrating directly with internal systems via secure APIs. The platform delivers seamless, multilingual, and policy-compliant support, helping institutions automate routine calls and deliver instant, human-like service 24/7.

Key Features

Task Completion, Not Just Answers: Trace’s AI agents independently execute tasks (e.g., replacing cards, tracking transactions, submitting applications, resolving lockouts) within your institution’s systems, not just providing instructions.

Secure and Compliant: Agents never access user information without explicit authentication and strictly follow company policies, ensuring compliance and data privacy.

Multilingual Support: Deploy agents in any language, with examples in Hindi, Turkish, French, and more-enabling global customer service.

Seamless, Human-Like Experience: Agents don’t follow scripts, interrupt users, or deflect to self-service flows. They interact naturally and allow users to pause or interrupt anytime.

Private and Flexible Hosting: Data never leaves your control-Trace can be hosted with your existing cloud provider for maximum privacy.

Real-Time Omnichannel Support: Provide tailored responses over voice, chat, or email, with instant and consistent support.

Low Latency and Scalability: <0.2 seconds to first response, supporting instant, scalable phone support lines without massive staffing costs.

High First Contact Resolution: Achieve up to 95% resolution on first contact without human handoff.

Built on Advanced Research: Outperforms traditional chatbots and GPT wrappers by specializing in secure, action-oriented customer service.

Use Cases

Card replacement and transaction tracking for banks and fintechs

Application processing for cards, loans, or insurance products

Fraud reporting and complaint resolution

Account lockout assistance and identity verification

Multilingual, 24/7 customer support for financial institutions

Model Selection

Prebuilt Financial Workflows: Card management, transaction tracking, fraud, lockouts, and more.

Custom Use Cases: Tailor agents to your institution’s most common customer requests.

Getting Started

Website: tracetec.co

Live Demo: Sign Up for Demo

Contact: Email Trace

Platform Overview: Learn More

Trace empowers financial institutions to deliver secure, instant, and reliable customer service with AI agents that don’t just answer questions-they get things done.